050 2018 2540。 How to reset password on HP Aruba 2540 / 2500

2018 Mahindra 2540 Shuttle W/ Loader for sale in Beckley, WV. United Cycle

Claim of exemption: Nonprofit organization created for religious, charitable or educational purposes. If a purchaser who gives a resale certificate makes any use of the property other than retention, demonstration or display while holding it for sale in the regular course of business: a The use is taxable to the purchaser as of the time the property is first so used by him or her, and the sales price of the property to the purchaser is the measure of the tax. Available in 37 to 65 HP and 3- and 4-cylinder engines, this tractor allows you to customize your machine to your specific operation. However, this may not be a fair comparison. Therefore, due to the short duration of follow-up for both the FOURIER 2. 345 Use tax: Property on which sales tax paid. [62:397:1955] — Added in 1988. 170 Liability of purchaser who gives and seller who takes resale certificate. Sale to United States, State or political subdivision. Status Sold• The Department may recover any refund or part of it which is erroneously made and any credit or part of it which is erroneously allowed in an action brought in a court of competent jurisdiction in Carson City or Clark County in the name of the State of Nevada. Proposed by the 1995 Legislature; adopted by the people at the 1996 general election, effective January 1, 1997. A B C D E F G H I Quick coupler 2380 Swing 2120 5320 5740 5890 2590 1890 540 500 3740 without Quick coupler 2190 Swing 1950 5230 5540 5700 1720 465 445 3540 J K L M N O P Q R Quick coupler 2380 3550 5700 3680 1340 350 650 125 35 without Quick coupler 2690 3360 5530 3870 1500 S T U V W X Y Z a Quick coupler 2540 1590 1940 1970 970 without Quick coupler ViO55-6B Unit:mm A B C D E F G H I Quick coupler 2370 Swing 2110 5580 6140 6290 2590 1890 540 500 4120 without Quick coupler 2180 Swing 1940 5510 5950 6100 1720 465 445 3920 J K L M N O P Q R Quick coupler 2560 3900 6060 4050 1410 400 700 125 35 without Quick coupler 2930 3710 5900 4240 1570 S T U V W X Y Z a Quick coupler 2540 1590 1990 1970 995 without Quick coupler Specifications ViO50-6B. 発信者の名前と住所を報告します。

10

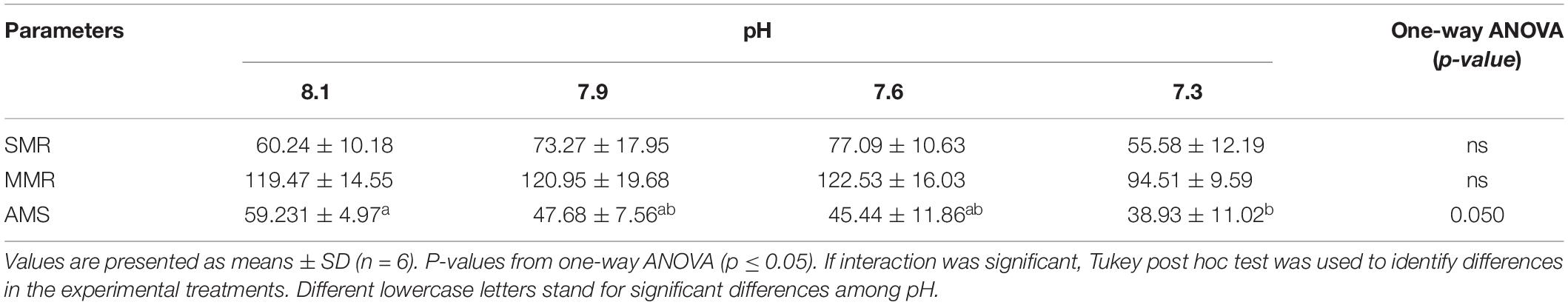

Reduction of low density lipoprotein

Cumulative duration of treatment years. Added to NRS by ; A ; ; ; NRS 372. Clearance with Bucket Fully Dumped: 73 in. Any person who gives a resale certificate for property which the person knows at the time of purchase is not to be resold by the person in the regular course of business for the purpose of evading payment to the seller of the amount of the tax applicable to the transaction is guilty of a misdemeanor. Median follow-up in ODESSEY is anticipated to be 33 months 2. Among 10 621 patients with a baseline LDL-C greater than 2. e A transfer for a consideration of the title or possession of tangible personal property which has been produced, fabricated or printed to the special order of the customer, or of any publication. 326 Personal property sold by or to nonprofit organization created for religious, charitable or educational purposes. Digging Force - Dipper lbs. 265 Constitutional and statutory exemptions. Taxation of photographers: Furnishing of proofs considered to be rendition of service. Interior Color WHITE• b The cost of materials used, labor or service cost, interest charged, losses, or any other expenses. There are exempted from the taxes imposed by this chapter the gross receipts from occasional sales of tangible personal property and the storage, use or other consumption in this State of tangible personal property, the transfer of which to the purchaser is an occasional sale. Meals and food products sold to students or teachers by school, organization of students or parent-teacher association. Facilities operated by the vendor; 2. An organization is created for religious purposes if: a It complies with the requirements set forth in subsection 5; and b The sole or primary purpose of the organization is the operation of a church, synagogue or other place of religious worship at which nonprofit religious services and activities are regularly conducted. You can search for available devices connected via USB and the network, select one, and then print. SECURITY Authority of Department; amount; sales; return of surplus. 205 Advertisement of assumption or absorption of tax by retailer unlawful. Be substantially in such form and include such information as the Department may prescribe; and 2. c Any amount for which credit is allowed by the seller to the purchaser. There are exempted from the taxes imposed by this act the gross receipts from sales and the storage, use or other consumption of: a Prosthetic devices, orthotic appliances and ambulatory casts for human use, and other supports and casts if prescribed or applied by a licensed provider of health care, within his scope of practice, for human use. c The price received for labor or services used in installing or applying the property sold. The Department may by regulation provide that the amount collected by the retailer from the consumer in reimbursement of the tax be displayed separately from the list price, the price advertised in the premises, the marked price, or other price on the sales check or other proof of sale. b The sale price of property returned by customers when the full sale price is refunded either in cash or credit, but this exclusion does not apply in any instance when the customer, in order to obtain the refund, is required to purchase other property at a price greater than the amount charged for the property that is returned. This act shall take effect on the first day of the third month next following enactment, except the commissioner may take any anticipatory administrative action in advance as shall be necessary for the implementation of this act. Powerful, reliable 40 hp 4-cylinder engine• そういった時は着信があった番号の最初に「184」をつけることで非通知にする事が出来ます。 Any form of animal life of a kind the products of which ordinarily constitute food for human consumption. Fertilizer to be applied to land the products of which are to be used as food for human consumption or sold in the regular course of business. The term does not include a motor home as defined in. Stock Number N51204• The Department shall fix the amount of the security which, except as otherwise provided in subsection 2, may not be greater than twice the estimated average tax due quarterly of persons filing returns for quarterly periods, three times the estimated average tax due monthly of persons filing returns for monthly periods or four times the estimated average tax due annually of persons filing returns for annual periods, determined in such a manner as the Department deems proper. He shall include the retail selling price of the property in his gross receipts. Within 90 days after a final decision upon a claim filed pursuant to this chapter is rendered by the Nevada Tax Commission, the claimant may bring an action against the Department on the grounds set forth in the claim in a court of competent jurisdiction in Carson City, the county of this State where the claimant resides or maintains his or her principal place of business or a county in which any relevant proceedings were conducted by the Department, for the recovery of the whole or any part of the amount with respect to which the claim has been disallowed. Stabilizer Down Below Grade: 10 in. The Department, whenever it deems it necessary to insure compliance with this chapter, may require any person subject to the chapter to place with it such security as the Department may determine. When the Tax Commission determines that it is necessary for the efficient administration of this chapter to regard any salesmen, representatives, peddlers or canvassers as the agents of the dealers, distributors, supervisors or employers under whom they operate or from whom they obtain the tangible personal property sold by them, irrespective of whether they are making sales on their own behalf or on behalf of such dealers, distributors, supervisors or employers, the Tax Commission may so regard them and may regard the dealers, distributors, supervisors or employers as retailers for purposes of this chapter. Liability of purchaser giving resale certificate: Use of article bought for resale. 120 Display of tax separately from price. , Indeed, when plotted on the CTT regression line, the results of the FOURIER trial does appear to fall slightly below the regression line describing the average expected benefit from treatment with a statin Figure A. 180 Resale certificate: Commingled fungible goods. There are exempted from the taxes imposed by this chapter an amount equal to 40 percent of the gross receipts from the sales and storage, use or other consumption of new manufactured homes and new mobile homes. Any return required to be filed by this section must be combined with any return required to be filed pursuant to the provisions of of NRS. [ ]. Delivery of return; remittance. There are exempted from the computation of the amount of the sales tax the gross receipts from sales of tangible personal property to a common carrier, shipped by the seller via the purchasing carrier under a bill of lading, whether the freight is paid in advance or the shipment is made freight charges collect, to a point outside this State and the property is actually transported to the out-of-state destination for use by the carrier in the conduct of its business as a common carrier. Presumption of purchase for use in this State. b The use tax, a return must be filed by each retailer maintaining a place of business in the State and by each person purchasing tangible personal property, the storage, use or other consumption of which is subject to the use tax, who has not paid the use tax due. Except as otherwise provided in subsection 12, upon determining that a retailer has filed a return which contains one or more violations of the provisions of this section, the Department shall: a For the first return of any retailer which contains one or more violations, issue a letter of warning to the retailer which provides an explanation of the violation or violations contained in the return. Raise Boom seconds : 4. 3261 Requirements for organization created for religious, charitable or educational purposes. Reporting and payment periods. comThis is our 2018 Parker 2510 XL powered by a 300 Hp Yamaha 4 stroke with only 45 hours of use. 190 Liability for tax; extinguishment of liability. You can disable this feature by using the following command: Syntax:. 283 Prosthetic devices, orthotic appliances and certain supports and casts; appliances and supplies relating to ostomy; products for hemodialysis; medicine. Use tax: Property on which sales tax paid. The Legislature shall establish: 1. , Similarly, in two large-scale cardiovascular outcomes trials designated as SPIRE-1 and SPIRE-2, a total of 27 438 participants with either a history of cardiovascular disease, familial hypercholesterolaemia or who were at high risk for cardiovascular disease were randomized to either 150 mg every 2 weeks of bococizumab subcutaneously or matching placebo. Transport Height max : 81 in. For the purposes of , an organization is created for religious, charitable or educational purposes if it complies with the provisions of this section. Injunction or other process to prevent collection of tax prohibited. , By contrast, there was a numerically greater number of patients who experienced new onset diabetes in the FOURIER trial HR: 1. comNew this boat Sells for 130K with out electronics. If a purchaser wishes to claim an exemption from the taxes imposed by this chapter, the retailer shall obtain such information from the purchaser as is required by the Department. Certain broadcasting activities not taxable transactions. Standards for determining whether an organization is created for religious, charitable or educational purposes. See Statutes of Nevada 1989, p. Circumstances under which veterinarian is considered consumer of tangible personal property. , in order to effectuate the provisions of this section. CTT is the Cholesterol Treatment Trialists meta-analysis of statin trials. Computation of amount of taxes due. [61:397:1955] — Amended in 1970. We may disclose all of the information we collect, as described above, to companies that perform marketing services on our behalf or to financial institutions with whom we have joint marketing agreements. Action for refund: Claim as condition precedent. If approved by the State Board of Examiners, the excess amount collected or paid must, after being credited against any amount then due from the person in accordance with , be refunded to the person, or his or her successors, administrators or executors. c Returnable containers when sold with the contents in connection with a retail sale of the contents or when resold for refilling. The application must be on a form and contain such information as is required by the Department. Application of to sale of certain medical devices to governmental entities. : 3080• Provisions required in certain purchasing contracts of State or political subdivision. Delivery by the vendor to a customs broker or forwarding agent for shipment outside this State. If you forgot your login credentials to your Aruba or HP Switch without doing the usual password-recovery steps. For commercial re-use, please contact journals. b Other evidence satisfactory to the Department that the property was not purchased for storage, use or other consumption in this State. Authority of Department to act for people of State. This information is stored on the hard disk of the PC running the Agent software. Presumption that property delivered outside this State to certain purchasers was purchased for use in this State. 🙂 This front-panel password clear feature is enabled by default to allow this way of resetting the password. , It is important to note, however, that the naturally randomized genetic evidence suggests that only persons with impaired fasting glucose are at risk for PCSK9 or statin induced new onset diabetes. There was no evidence of any increased risk of neurocognitive effects or cataracts in either trial. THE INFORMATION IS SUBMITTED FOR THE PURPOSES OF OBTAINING CREDIT AND AUTHORIZES THE DEALER TO MAKE SUCH INQUIRIES AS ARE NECESSARY TO OBTAIN CREDIT INFORMATION AND AUTHORIZE MY BANK, SUPPLIERS, AND CREDIT REFERENCES TO RELEASE INFORMATION REGARDING MY ACCOUNT S. A permit is not assignable and is valid only for the person in whose name it is issued and for the transaction of business at the place designated on it. For the purpose of the proper administration of this chapter and to prevent evasion of the use tax and the duty to collect the use tax, it is presumed that tangible personal property sold by any person for delivery in this State is sold for storage, use or other consumption in this State until the contrary is established. has received research grants from Amgen, Astrazeneca , honoraria from Amgen, Astrazeneca and other from Amgen, Atrazeneca, Sanofi, Pfizer. The fact that the clinical benefit of both PCSK9 inhibitors and statins depends on the absolute magnitude of the achieved LDL-C reduction and the total duration of treatment has important implications for the on-going ODYSSEY OUTCOMES trial. Application of doctrine of res judicata. Loader Model: 2540L• The Department may sell the security at public auction if it becomes necessary to recover any tax or any amount required to be collected, or interest or penalty due. BizPlatform(05020182540)からの着信やSMSは無視しても大丈夫? この番号が誰だか分からない番号だと、無視や放置をして良いのか気になります。 The term does not include: 1 A vehicle required to be registered pursuant to the provisions of or of NRS; or 2 Machinery or equipment only incidentally employed for agricultural purposes. Dry Weight 6,220 lbs. [Effective through June 30, 2035. The provisions of this chapter relating to: a The imposition, collection and remittance of the sales tax apply to every retailer whose activities have a sufficient nexus with this State to satisfy the requirements of the United States Constitution. The tax is imposed with respect to all property which was acquired out of state in a transaction that would have been a taxable sale if it had occurred within this State. For the purposes of subsection 4, if the first violation of this section by any retailer was determined by the Department through an audit which covered more than one return of the retailer, the Department shall treat all returns which were determined through the same audit to contain a violation or violations in the manner provided in paragraph a of subsection 4. Claim of exemption: Information required; electronic system; identification system; records; liability for improper claim. A retailer shall maintain such records of exempt transactions as are required by the Department and provide those records to the Department upon request. 重要な連絡の可能性もありますので下記の簡易アンケートやみなさんからのクチコミ情報提供を参考にしてみて下さい。

19

Indian Motorcycle OEM Parts

Any organization created for religious, charitable or eleemosynary purposes, provided that no part of the net earnings of any such organization inures to the benefit of any private shareholder or individual. Class DUAL CONSOLE• 7281 Application of to sale of property to certain members of Nevada National Guard, relatives of such members and relatives of certain deceased members of Nevada National Guard. RETURNS AND PAYMENTS Taxes collected to be held in separate account. 395 Extension of time for filing return and paying tax. 240 Liability of purchaser giving resale certificate: Use of article bought for resale. Textbooks sold within Nevada System of Higher Education. If the claimant is aggrieved by the decision of the Commission on appeal, the claimant may, within 45 days after the decision is rendered, bring an action against the Department on the grounds set forth in the claim for the recovery of the whole or any part of the amount claimed as an overpayment. Flat deck platform• この番号からの着信やSMSの内容については現在調査中です。 For the purposes of the tax on the use or other consumption of tangible personal property, the complimentary portion of any such food, meals or nonalcoholic drinks does not lose its tax-exempt status as food for human consumption as the result of being provided on a complimentary basis, in whole or in part, to the employees, patrons or guests of the retailer. Last Updated on: December 9, 2020 with 2018 Parker 2540 DC. Credit or refund for use tax: Reimbursement of vendor for sales tax. Affixing and cancelling of revenue stamps. 忙しい時に掛かってくる営業電話のような迷惑電話なら無視しても良いと思いますが、知らない番号からだと怖くて電話に出る事が出来ず、ひょっとして重要な電話や連絡かと思うと不安になってしまいます。 For the purposes of a permit obtained pursuant to , the person shall be deemed to have a single place of business in this State. Improper use of resale certificate; penalty. Any overpayment of the use tax by a purchaser to a retailer who is required to collect the tax and who gives the purchaser a receipt therefor pursuant to sections 34 to 38, inclusive, of the Sales and Use Tax Act chapter 397, Statutes of Nevada 1955 and to , inclusive, must be credited or refunded by the State to the purchaser, subject to the requirements of. 390 Affixing and cancelling of revenue stamps. The balance of the judgment must be refunded to the plaintiff. Reimbursement for collection of tax. Lease and rental receipts: Reporting; payment. Some administrators would prefer to disable this function for security. This chapter is known and may be cited as the Sales and Use Tax Act. ] Employment of accountants, investigators and other persons; delegation of authority. c The furnishing, preparing, or serving for a consideration of food, meals or drinks. A licensed optometrist or physician and surgeon is a consumer of, and shall not be considered, a retailer within the provisions of this chapter, with respect to the ophthalmic materials used or furnished by him in the performance of his professional services in the diagnosis, treatment or correction of conditions of the human eye, including the adaptation of lenses or frames for the aid thereof. Advertisement of assumption or absorption of tax by retailer unlawful. STATEMENT This bill would require the Department of Community Affairs DCA to verify that an applicant is not deceased prior to awarding the applicant Low Income Home Energy Assistance Program LIHEAP benefits, and on a periodic basis after awarding these benefits. c Such other information as the Department may require. In the case of persons who are habitually delinquent in their obligations under this chapter, the amount of the security may not be greater than three times the average actual tax due quarterly of persons filing returns for quarterly periods, five times the average actual tax due monthly of persons filing returns for monthly periods or seven times the average actual tax due annually of persons filing returns for annual periods. A Effect of variants that mimic proprotein convertase subtilisin-kexin type 9 PCSK9 inhibitors as compared to variants that mimic statins on the risk of various cardiovascular outcomes per 0. 05020182540の場合ですと 18405020182540で発信すると相手に番号を知られること無く非通知でかける事が可能です。

6

Downloads

Furthermore, this concordance strongly suggests that the effect of both PCSK9 inhibitors and statins on the risk of cardiovascular events is due entirely to the absolute achieved reduction in LDL-C rather than to potential pleiotropic effects. 2 Articles which are in the nature of instruments, crutches, canes, devices or other mechanical, electronic, optical or physical equipment. The storage, use or other consumption in this State of property, the gross receipts from the sale of which are required to be included in the measure of the sales tax, is exempted from the use tax. b Any transfer of all or substantially all the property held or used by a person in the course of such an activity when after such transfer the real or ultimate ownership of such property is substantially similar to that which existed before such transfer. The Department of Community Affairs shall verify that an applicant for benefits under the federal Low Income Home Energy Assistance Program, established by 42 U. d Medicines: 1 Prescribed for the treatment of a human being by a person authorized to prescribe medicines, and dispensed on a prescription filled by a registered pharmacist in accordance with law; 2 Furnished by a licensed physician, dentist or podiatric physician to his own patient for the treatment of the patient; 3 Furnished by a hospital for treatment of any person pursuant to the order of a licensed physician, dentist or podiatric physician; or 4 Sold to a licensed physician, dentist, podiatric physician or hospital for the treatment of a human being. Proposed by the 2005 Legislature; adopted by the people at the 2006 General Election, effective January 1, 2007. Any nonprofit organization created for religious, charitable or educational purposes that wishes to claim an exemption pursuant to , must file an application with the Department to obtain a letter of exemption. If the amount of the bad debt is greater than the amount of the taxable sales reported for the period during which the bad debt is claimed as a deduction, a claim for a refund may be filed pursuant to to , inclusive, except that the time within which the claim may be filed begins on the date on which the return that included the deduction was filed. The provisions of this subsection do not apply if the retailer: a Fraudulently fails to collect the tax; b Solicits a purchaser to participate in an unlawful claim of an exemption; or c Accepts a certificate of exemption from a purchaser who claims an entity-based exemption, the subject of the transaction sought to be covered by the certificate is actually received by the purchaser at a location operated by the seller, and the Department provides, and posts on a website or other Internet site that is operated or administered by or on behalf of the Department, a certificate of exemption which clearly and affirmatively indicates that the claimed exemption is not available. The Department may prescribe the extent to which any regulation may be applied without retroactive effect. For purposes of the sales tax, if the retailers establish to the satisfaction of the Tax Commission that the sales tax has been added to the total amount of the sale price and has not been absorbed by them, the total amount of the sale price shall be deemed to be the amount received exclusive of the tax imposed. The taxes imposed under this chapter apply to the sale of tangible personal property to and the storage, use or other consumption in this State of tangible personal property by a contractor for a governmental, religious or charitable entity which is otherwise exempted from the tax unless the contractor is a constituent part of that entity. 7247 Applicability to retailers that enter into certain agreements with residents of this State for the referral of customers through Internet links; construction of certain terms. Form and contents of claim for credit or refund. Redesigned headlight assembly• 640 Credit or refund for use tax: Reimbursement of vendor for sales tax. Advertisement of assumption or absorption of tax by retailer unlawful; penalty. 282 Durable medical equipment, mobility enhancing equipment and oxygen delivery equipment. Right of appeal on failure of Department to mail notice of action on claim. Indian reservations and colonies: Imposition and collection of sales tax. A judgment may not be rendered in favor of the plaintiff in any action brought against the Department to recover any amount paid when the action is brought by or in the name of an assignee of the person paying the amount or by any person other than the person who paid the amount. Backhoe Model: 2540B• Attachment Rollback Angle: 35 deg. There are exempted from the computation of the amount of the sales tax the gross receipts from any sale of tangible personal property which is shipped to a point outside this State pursuant to the contract of sale by delivery by the vendor to such point by means of: 1.。 Application and calculation of tax on property purchased for certain purposes related to aircraft and components of aircraft. Extension of time for filing return and paying tax. The notices may be served personally or by mail in the manner prescribed for service of notice of a deficiency determination. 348 Claim of exemption: Nonprofit organization created for religious, charitable or educational purposes. Therefore, based on an expected median follow-up of 33 months 2. WIRTHS District 24 Morris, Sussex and Warren Co-Sponsored by: Assemblyman Webber SYNOPSIS Requires DCA to verify that low-income home energy assistance benefits are not awarded to deceased individuals. , In the FOURIER trial, 27 564 patients with cardiovascular disease and LDL-C levels above 1. The tax required to be collected by the retailer constitutes a debt owed by the retailer to this State. L has received honoraria from Amgen, Sanofi, Medicines Company, Berlin Chemie, MSD. Every application for a permit must: a Be made upon a form prescribed by the Department. Certain broadcasters, printers, advertising firms, distributors and publishers deemed agents and retailers maintaining place of business in this State. If the Department determines that the organization is created for religious, charitable or educational purposes, it shall issue a letter of exemption to the organization. The return must also show the amount of the taxes for the period covered by the return and such other information as the Department deems necessary for the proper administration of this chapter. There are exempted from the taxes imposed by this Act the gross receipts from the sale, storage, use or other consumption in a county of farm machinery and equipment. Disclaimer We strive to ensure all pricing and information contained in this website is accurate. [48:397:1955] — NRS A NRS 372. Great serviceability access• No refund may be allowed unless a claim for it is filed with the Department within 3 years after the last day of the month following the close of the period for which the overpayment was made. 05020182540は調べたところ BizPlatformのようですね。 The term includes splints, bandages, pads, compresses and dressings. Proposed by the 2017 Legislature; adopted by the people at the 2018 General Election, effective January 1, 2019. The sale of farm machinery and equipment, as defined in , to a nonresident who submits proof to the vendor that the farm machinery and equipment will be delivered out of State not later than 15 days after the sale; and 3. The failure to follow correct procedures and use correct tools could result in serious injury or death. Whenever any person fails to comply with any provision of this chapter relating to the sales tax or any regulation of the Department relating to the sales tax prescribed and adopted under this chapter, the Department, after a hearing of which the person was given prior notice of at least 10 days in writing specifying the time and place of the hearing and requiring the person to show cause why his or her permit or permits should not be revoked, may revoke or suspend any one or more of the permits held by the person. An excise tax is hereby imposed on the storage, use or other consumption in this State of tangible personal property purchased from any retailer on or after July 1, 1955, for storage, use or other consumption in this State at the rate of 2 percent of the sales price of the property. There are exempted from the taxes imposed by this chapter the gross receipts from sales of, and the storage, use or other consumption in this State of: a Nonreturnable containers when sold without the contents to persons who place the contents in the container and sell the contents together with the container. Presumption that certain property delivered outside this State was not purchased for use in this State. これはより多くの人々を助けることができます。

3

How to reset password on HP Aruba 2540 / 2500

。 。 。

2018 PARKER 2540 DC

。

8

NRS: CHAPTER 372

。