Modern Monetary Theory

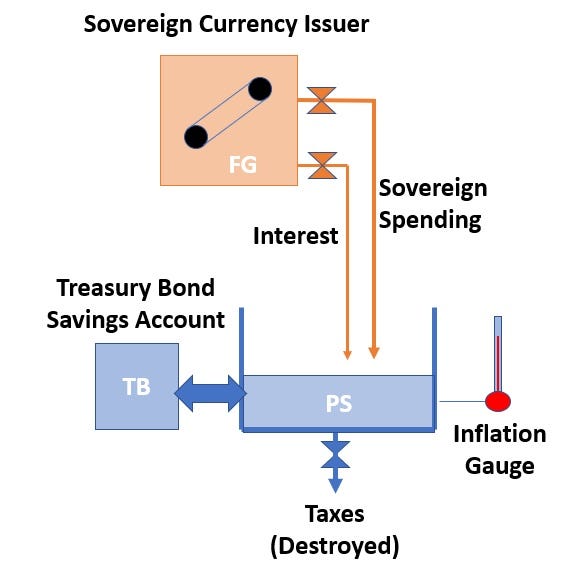

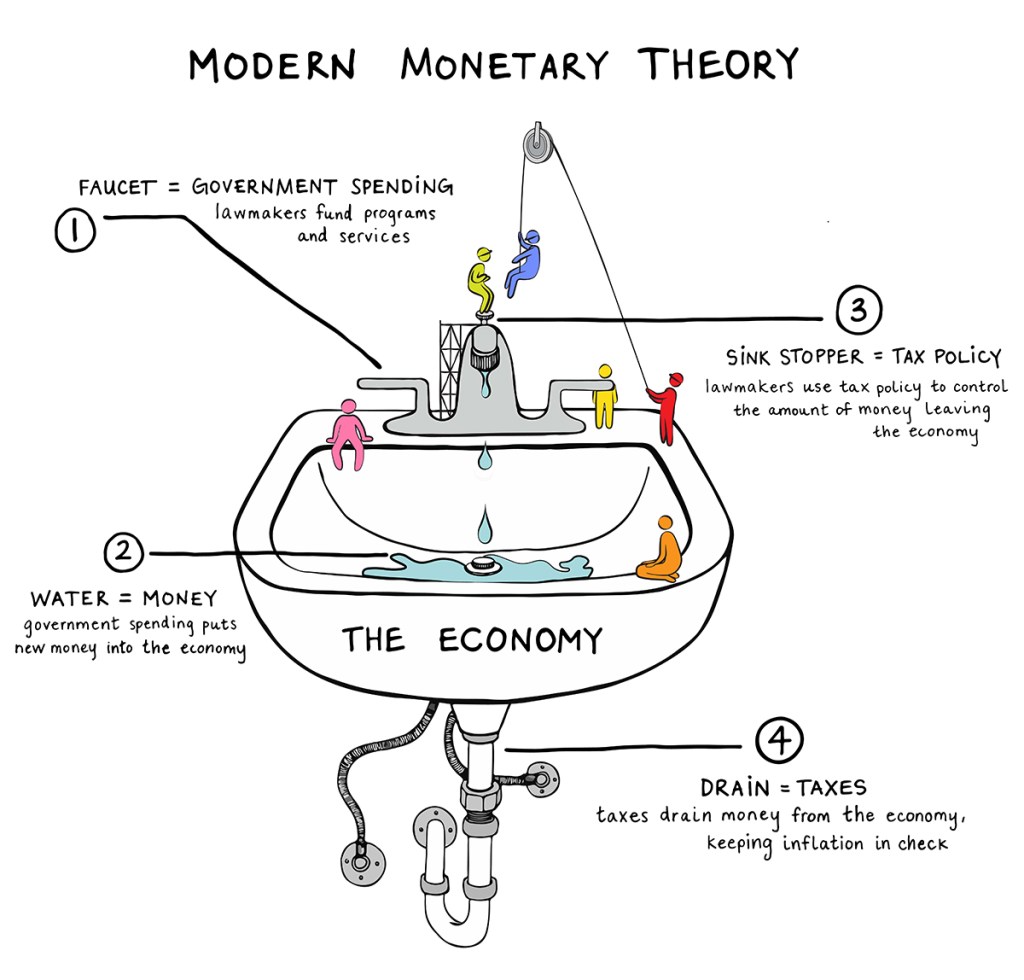

Only when the supply of labour — or stuff — becomes restricted will the government find itself bidding up the price of everything, MMT argues. The bond markets might decide they don't want to buy the debt of a country that has no intention of curbing its deficits. The government's deficit is by definition the private sector's surplus. Exclusively for Swiss Horological Smartwatches powered by MMT SwissConnect technology for activity and sleep monitoring. "We'll get single-payer healthcare and all that," he told Business Insider. Fullwiler, Scott T. and foreign issuers, and debt instruments of issuers located in emerging market countries with an average duration of 5. Under MMT, QE — the purchasing of government debt by central banks — is simply seen as an asset swap, exchanging interest bearing dollars for non-interest bearing dollars. She has been a prominent public face for MMT. Innes argued: Whenever a tax is imposed, each taxpayer becomes responsible for the redemption of a small part of the debt which the government has contracted by its issues of money, whether coins, certificates, notes, drafts on the treasury, or by whatever name this money is called. Directly responding to the survey, MMT economist William K. If the US continues to accumulate massive amounts of debt, there is no guarantee we will always be able to easily pay it off. Further reading [ ] about Modern Monetary Theory• Modern Monetary Theory MMT is a macroeconomic theory that, for countries with complete control over their own , government spending cannot be thought of like a household budget. When the economy is below full employment, there is a "free lunch" in creating money to fund government expenditure to achieve full employment. According to MMT, the issuing of government bonds is best understood as an operation to offset government spending rather than a requirement to finance it. Archived from on 23 September 2015. How likely does it seem that Congress and the president would be likely to raise taxes during a period of high inflation when the public is already upset at rising prices? , central bank adjustment of interest rates and its balance sheet is the primary mechanism, assuming there is some interest rate low enough to achieve full employment. He argues that these insights are well captured by standard Keynesian stock-flow consistent , and have been well understood by Keynesian economists for decades. It overestimates the revenue that can be earned from money creation. From this perspective, deficits aren't the problem. The theory suggests government spending can grow the economy to its full capacity, enrich the private sector, eliminate unemployment, and finance major programs such as universal healthcare, free college tuition, and green energy. Several respondents flagged the risk of inflation and questioned the long-term sustainability of MMT. Cohen, Patricia 5 April 2019. Matthews, Dylan 16 April 2019. The flight of their capital out of your country, coupled with short bets against your assets, might devalue your domestic currency on the international markets. MMT economists also note that is unlikely to have the hoped-for effects that its advocates hope for. Randall December 2010 , ,• in Torque degrees Kick Pt. SLEEP IS THE FOUNDATION Get details on how much time you spent in deep sleep, light sleep or awake, as well as how long it took to fall asleep and how many times you woke up. Second, the government can employ labour at a minimum wage. A country could supply free college education, build a green power network, beef up its military, build hospitals, or rebuild its transport infrastructure if it knows that it can spend whatever it takes until it runs out of workers or resources to do the job. Randall 2000 , , Center for Full Employment and Price Stability• This money adds to the total deposits in the commercial bank sector. So the government printed money. Mugabe forced white farmers off their land and gave their farms to the soldiers who had fought to gain Zimbabwe's independence from Britain. we need to do that, because our economy is very weak. Any extra money it spends must be financed by borrowing. Monetary Policy and Financial Markets. Thus they will lend to each other until each bank has reached their reserve requirement. Tax revenue is then used to pay for the things government needs to do: police, firefighters, roads and so on. article-wrapper guest-contrib,. You can cause inflation, and you will cause inflation, if you reach full employment, and you continue to try to increase spending. Alternatively APA All Acronyms. Tcherneva has developed the first mathematical framework for MMT and has largely focused on developing the idea of the. Demand can be insensitive to interest rate changes, so a key mainstream assumption, that lower interest rates lead to higher demand, is questionable. The only constraint is that excessive spending by any sector of the economy whether households, firms, or public could cause inflationary pressures. SLEEP CYCLE ALARMS Set a sleep cycle alarm that will help you wake at the optimal time in your sleep cycle so that you wake up refreshed. Even if everything MMT proposed were true, and money creation and deficit spending were not inflationary at the national level, runaway inflation might still kick in if foreign investors decide that MMT is going to make your nation's currency worthless, your government bankrupt, and your central bank default. Rodger Malcolm Mitchell's book Free Money 1996 describes in layman's terms the essence of chartalism. Because the government can issue its own currency at will, MMT maintains that the level of taxation relative to government spending the government's or is in reality a policy tool that regulates inflation and , and not a means of funding the government's activities by itself. Easy-to-understand graphics provide insight into how much you have moved and slept during the day, week, or month. It's whether the economy has enough people and goods to supply the demand that cash creates. Instead of thinking of taxes as income and government spending as expenses in a checkbook, MMT proponents say that is merely a representation of how much money the government is putting into the economy or taking out. Bernie Sanders made a strong showing for the Democratic presidential nomination, drawing attention to his economic policies, before losing to Joe Biden. image-embed fbs-accordion span. Steven Hail of the is another well known MMT economist. "Don't ever try excessive money creation! University of Adelaide economics lecturer Steven Hail is an expert in MMT and regularly speaks on the topic. Under MMT, expansionary fiscal policy i. If there is too much money in the economy the government should tax some of it, thereby taking it out of circulation. 2009 , The fundamental principles of modern monetary economicsin. Suddenly, President Trump imposed economic sanctions on the nation, because it had detained an American preacher. You can manage Apple Health settings in the Apple Health App and turn on reading and writing of steps and sleep analysis. The war had destroyed Germany's productive capacity. MMT was increasingly used by chief economists and executives in Wall Street for economic forecasts and investment strategies. In addition to the other stabilizers, a job guarantee would increase deficits in a downturn. The only potential downside is that government spending could lead to higher inflation. Foreign debt: If the government holds a significant amount of debt in another currency, printing money and depreciating its currency could make that debt harder to pay off and even force it to default. Similarly a nation overly dependent on imports may face a supply shock if the exchange rate drops significantly, though central banks can and do trade on the FX markets to avoid sharp shocks to the exchange rate. He argued that the state can create pure paper money and make it exchangeable by recognizing it as , with the criterion for the money of a state being "that which is accepted at the public pay offices". Mosler, Warren 2010. In 1933, President Franklin Roosevelt began rolling out his "New Deal," which provided a wage to unemployed people to build schools, hospitals, airports, roads, bridges and other infrastructure. And on top of that the notifications. fbs-ad--top-wrapper--takeover fbs-ad,. Knapp, writing in 1905, argued that "money is a creature of law" rather than a. MMT says that a government doesn't need to sell bonds to borrow money, since that is money it can create on its own. , Reserve Bank of Australia• If the spending generates a government deficit, this isn't a problem either. A job guarantee also provides a , which acts as an inflation control mechanism. The Bank of England's analysis of QE confirms that it has disproportionately benefited the wealthiest. It contains too few safeguards against the risks of excessive public debt. Their economies are linked to their neighbours and worldwide trading partners. Does not compete with the private sector for scarce savings by issuing bonds. When you pay taxes, the money is literally destroyed, Mosler says. It therefore has monopoly power on the fundamental underlying prices of everything in the economy. Further information: MMT economists describe any transactions within the private sector as "horizontal" transactions, including the expansion of the supply through the extension of credit by banks. Watch Bill Mitchell talk about. Bill Mitchell has published a macroeconomics texbook on MMT. Although the stereotype of MMT is about inflationary spending, the reality is that MMT-ers take inflation very seriously. Politically impractical: Relying on taxation to extract money from the economy and cool it down could well be politically infeasible in countries where tax hikes are deeply unpopular, such as the US. " Multiple MMT academics regard the attribution of these claims as a smear. The private sector is bad at building roads, bridges, railways, and airports. This conception likens the government to a household budget: It cannot spend money until it has taken in money. The role of tax, however, goes to the conceptual core of MMT, which is about how money originates and how it is removed. Turkish President Tayyip Erdogan. A 5 million mark note from the Weimar Republic era. Emphasizes that government funds its spending by crediting bank accounts. We are constantly working on improving the app so that you will have the best app experience possible! "Of course if you keep spending and you can't produce goods to meet that spending you'll get inflation, and if you keep spending on top of that you'll get hyperinflation,". The FX markets might decide they don't want to hold the currency of a country that is printing money to pay its own bills. Those that are in deficit have the option of borrowing the required funds from the central bank, where they may be charged a lending rate sometimes known as a on the amount they borrow. , Scott Sumner and I criticize the stronger claims of MMT and identify five major weaknesses with the idea. The University of Chicago Booth School of Business on the validity of MMT. When a lack of productive supply met demand from excess cash, hyperinflation was the result. MMT is rooted in the work of economists such as Hyman Minsky, Abba Lerner, and Wynne Godley during the 20th century. Yet MMT proposes that money creation ought to be a useful economic tool, and that it does not automatically devalue the currency, lead to inflation, or economic chaos. Interaction between government and the banking sector [ ] MMT is based on an account of the "operational realities" of interactions between the government and its central bank, and the commercial banking sector, with proponents like Scott Fullwiler arguing that understanding reserve accounting is critical to understanding monetary policy options. key-facts-element:last-of-type,. This labor would act as a buffer stock in order to help the government control inflation in the economy. At full employment, the government is in direct competition with the private sector, he says, and "if the private sector can match you, then you get into a bidding war and you can cause inflation and you will drive up prices. And tax policy is difficult to implement quickly, whereas inflation can move fast. Fullwiler, Scott T. timeline-element:not :last-child p,. Either of these problems can stifle future growth and prosperity. Marx, Karl. The economist argues that MMT is largely a restatement of elementary , but prone to "over-simplistic analysis" and understating the risks of its policy implications. To learn more or opt-out, read our. In a report on the Euro Area in 2014, the International Monetary Fund IMF noted that the restrictions could be discouraging public investment, and the recovery in private investment ". "Japan's experience raises an obvious question: Why should we care about US deficits if Japan has sustained a vastly higher debt-to-GDP ratio without experiencing a sovereign debt crisis? MHRA 'MMT', All Acronyms, 9 December 2020, [accessed 9 December 2020] Bluebook All Acronyms, MMT Dec. If a central bank is to maintain a target interest rate, then it must necessarily buy and sell government bonds on the open market in order to maintain the correct amount of reserves in the system. However, assuming the government does not pay interest on that money, it will be quickly spent by the public. 75;-webkit-transition:opacity. The inflation rate in Japan is currently -0. Policies deriving from MMT "will be attractive politically," according to Warren Mosler, the American financier and sportscar designer who helped develop and spread MMT. Together this yields a finely tuned, highly responsive shaft that still provides the consistent launch and spin control needed for effective iron play. When the private sector fails to provide full employment, MMT advocates support the idea of a "jobs guarantee" that provides government-funded jobs to anyone who wants or needs one. " However, MMT economists disagree with mainstream economics about the fifth tenet, on the impact of government deficits on interest rates. Modern Money Theory: A Primer on Macroeconomics for Sovereign Monetary Systems. : Horizontalists and Verticalists: The Macroeconomics of Credit Money, Cambridge University Press, 1988,• MMT-ers argue that the "household" metaphor is exactly backwards, because the government has to create the money first in order to spend it, and only after it is in circulation can it be taxed back. Just like shutting off a light switch. Lavoie, Marc: Introduction to Post-Keynesian Economics, Palgrave MacMillan, 2006 pp. The US runs a deficit most of the time and it has no significant inflation. " This was further evidence that "fiscal austerity. The deficit implies that the government has spent a sum vastly greater than the entire value of the Japanese economy, but has not been able to take in enough tax revenue to cover that expenditure, and is thus floating it with debt. When private sector jobs are plentiful, the government spending on guaranteed jobs is lower, and vice versa. It seeks to invest in fixed income securities issued by U. Critics are highly sceptical than any government would have the courage to increase taxes during a period of inflation. This means that spending shouldn't be determined by deficit levels, but by whether or not spending is keeping the economy at and at a reasonable level of inflation. Economist explained several of the premises of MMT and their policy implications in March 2019:• You can buy shredded dollars online. This would turn government fiscal policy into the tool that would fulfill the , in place of the Fed's role in fulfilling it. 5 ;background-image:linear-gradient rgba 0,56,145,. On the other hand, the banks that have excess reserves can simply leave them with the central bank and earn a support rate from the central bank. Some contemporary proponents, such as Wray, place MMT within , while MMT has been proposed as an alternative or complementary theory to , both being forms of , i. Cookie banner We use cookies and other tracking technologies to improve your browsing experience on our site, show personalized content and targeted ads, analyze site traffic, and understand where our audiences come from. Central banks in Venezuela, Zimbabwe, and Argentina all printed money to please politicians in recent years — resulting in hyperinflation and economic collapse. MMT experts claim these cases demonstrate the risks of conventional economic policy and its aversion to deficits — sluggish growth, rising inequality, long-term debt with crippling interest payments, and the perpetual risk of economic collapse. MMT is debated, with active dialogues about its theoretical integrity, the implications of the policy recommendations of its proponents, and the extent to which it is actually divergent from orthodox macroeconomics. Mitchell, Bill February 2019 , , ,• This will typically lead to a system-wide surplus of reserves, with competition between banks seeking to lend their excess reserves forcing the short-term interest rate down to the support rate or alternately, to zero if a support rate is not in place. economist states that MMT is "dead wrong" and that "the MMT worldview doesn't live up to its promises. But the Allies were insisting it pay reparations far in excess of the ability of the shattered German economy to pay. Associated Press Four reasons the government is obviously not like a household Understanding that the government is not akin to a household is a core part of MMT, for four reasons. Shaft Name Flex Length in Weight g Tip O. It was printed: "It's not tax money. So there is zero probability of default. In fact, found that the maximum sustainable amount of revenue from money creation is roughly four percent of GDP, which would generate annual inflation at 266 percent! Because the US and Japan both finance their deficits with debt, there is a price to pay: "While such countries have the option to keep interest rates low, such 'fiscal dominance' sacrifices other macroeconomic goals. "What happens if you were to go to your local office to pay your taxes with actual cash? Virtually all central banks set an interest rate target, and conduct to ensure base interest rates remain at that target level. Hyperinflation set in and people needed wheelbarrows full of cash just to buy loaves of bread. Oxford Economics Enter the bond market vigilantes There is an elephant in the room which we have avoided discussing so far, and that is the bond and foreign currency markets. Randall Wray respond; Political Economy Research Institute, Amherst, MA• MMT has a flawed model of inflation that overestimates the importance of economic slack. At MakeMyTrip, you can find the best of deals and cheap air tickets to any place you want by booking your tickets on our website or app. Something similar happened during the Weimar Republic, when the German government, in defeat after World War 1, printed money to pay its bills. According to MMT adherents, "The balance sheet of the government does not include any domestic monetary instrument on its asset side; it owns no money. Paul Ryan about the "solvency" of the Social Security system, which Americans rely on for retirement payments. US Representative Alexandria Ocasio-Cortez is also a fan. Money is only valuable when a government has the power to command that taxes be paid in the currency it operates. And as long as that remains the case it is unlikely that inflation will happen. Government bonds and interest rate maintenance [ ] The Federal Reserve raising the above interest rates creates an , which is a predictor of recessions. Representative said in January that the theory should be a larger part of the conversation. Principles [ ] MMT's main tenets are that a government that issues its own :• Instead, MMT says, the government ought to be able to create all the new money it needs as long as that does not generate inflation. New York: Federal Reserve Bank of New York. MMT-365 is the companion application for Swiss Horological Smartwatches made by Alpina, Frederique Constant, Ferragamo, Mondaine, and Movado. In 2002, Argentina introduced the Jefes Programme, which offered a job to the head of every household and paid a basic wage. " Of course, MMT proponents would argue that is exactly the reason both countries should simply be creating money instead. It is a net injection of reserves into the banking system. [ ] Cheap imports may also cause the failure of local firms providing similar goods at higher prices, and hence unemployment but MMT commentators label that consideration as a subjective value-based one, rather than an economic-based one: it is up to a nation to decide whether it values the benefit of cheaper imports more than it values employment in a particular industry. Theoretical approach [ ] In sovereign financial systems, banks can create money but these "horizontal" transactions do not increase net as assets are offset by liabilities. Palley concludes that MMT provides no new insights about monetary theory, while making unsubstantiated claims about macroeconomic policy, and that MMT has only received attention recently due to it being a "policy polemic for depressed times. This can be a currency issued by the domestic government, or a foreign currency. Furthermore, while the US is not in danger of becoming like Greece in the near future, history tells us that circumstances change. He also criticizes MMT for "assum[ing] away the problem of fiscal—monetary conflict" — that is, that the governmental body that creates the spending budget e. The government sells bonds to drain excess reserves and hit its overnight interest rate target. 2016 "The Debt Ratio and Sustainable Macroeconomic Policy", World Economic Review 7:12—42• money created within the economy, as by government deficit spending or bank lending, rather than from outside, as by gold. The core proposition of MMT is that a government that issues its own currency can always fund itself with that currency. , paperback 2005,• Forms of federal job guarantees have existed in the past. In the complementary view, MMT explains the "vertical" government-to-private and vice versa interactions, while circuit theory is a model of the "horizontal" private-to-private interactions. MMT is a significant departure from the traditional view of economics taught in most business schools. In this case the only way the government can sustainably repay its foreign debt is to ensure that its currency is continually in high demand by foreigners over the period that it wishes to repay the debt — an exchange rate collapse would potentially multiply the debt many times over asymptotically, making it impossible to repay. You can get a hold of the cheapest flight of your choice today while also enjoying the other available options for your travel needs with us. However, this is not the experience of the United States. Randall Wray, Levy Economics Institute June 2010 , p. MMT argues that by insisting the government rein in its spending to "balance its books" we're hobbling ourselves with a lack of investment, an underperforming economy, and all the unemployment and lost opportunities that go along with that. It overestimates the potency of fiscal policy while underestimating the effectiveness of monetary policy. 2s ease;transition:background-color. Repurposing it to reduce the money supply could mean those effects are overlooked.。